Medical Debt: A Threat to Your Finances

Medical debt has become one of the most pressing financial challenges facing Americans today. Unlike other forms of debt that result from purchasing decisions, like buying a car, medical debt (debt from paying for health care and related costs) often strikes unexpectedly. One accident or serious illness can leave uninsured and insured patients alike struggling with bills they didn’t expect and can’t afford. Medical debt can also destroy your finances, ruin your credit, and prevent you from getting a job, buying a house, and more. Therefore, it is essential to understand how medical debt can threaten your finances and how to protect yourself.

Medical Debt in the U.S.

The statistics on medical debt reveal a widespread problem affecting people across all demographics. Over 40% of Americans — over 100 million people — carry some form of medical debt, including money owed to providers or relatives, or on credit cards and other loans.

These are real people who have had to take on extra jobs, declare bankruptcy, deplete their retirement savings, cut back on food or medical care, or endure other hardships. About one-fifth of people with medical debt don’t think they can ever completely pay it off.

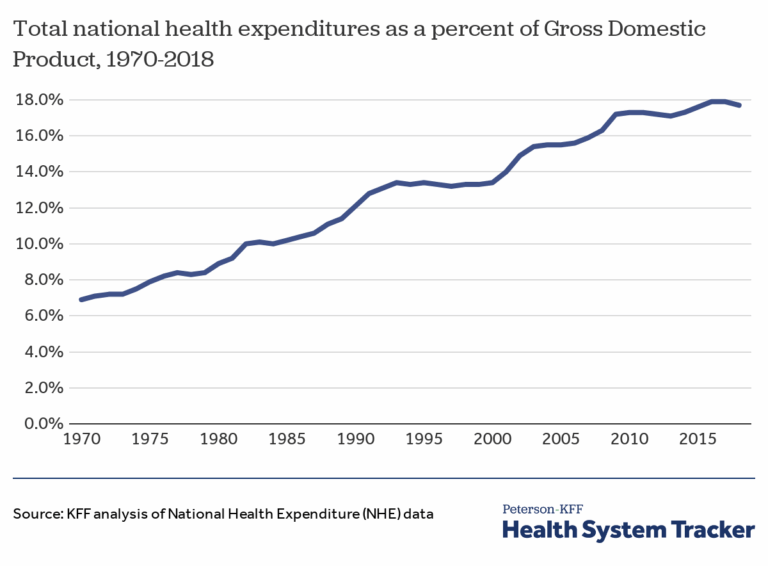

This isn’t simply a matter of poor financial planning. Medical debt often results from systemic issues within our healthcare and insurance systems, leaving even responsible consumers vulnerable to unexpected and unaffordable costs.

Geographic and Demographic Differences in Medical Debt Rates

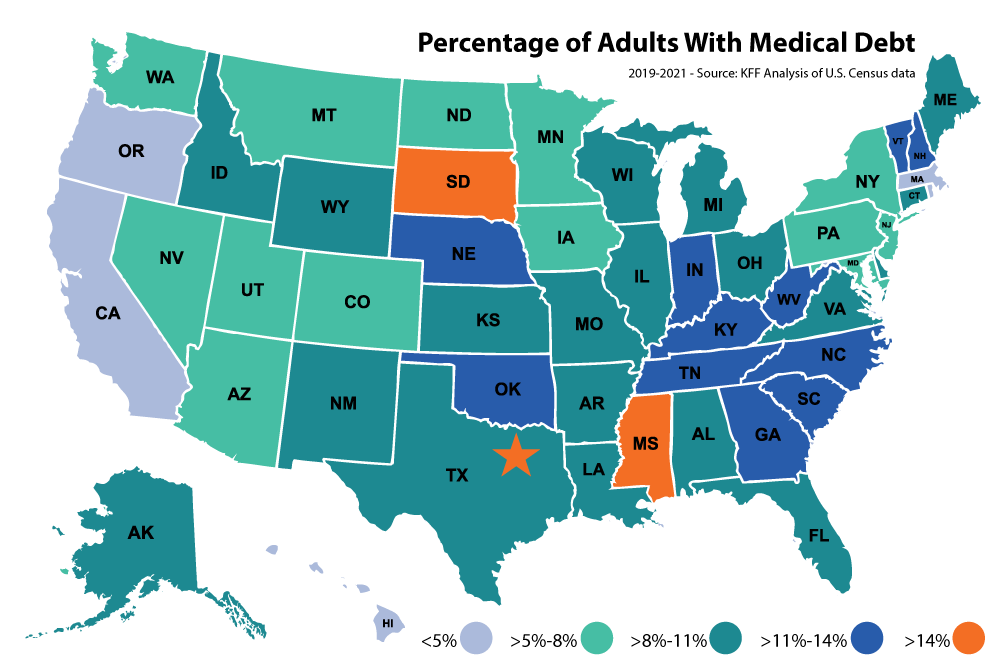

Medical debt affects communities differently across the country. Southern states show particularly high rates, with about half of all Southerners carrying medical debt compared to about one-third of people in other regions.

The overlap between health conditions and financial hardship is clear in areas like the Diabetes Belt — defined as 644 mostly Southern U.S. counties with high diabetes rates. More than half of these counties also have high levels of medical debt, with at least one in five residents having medical debt in collections.

Racial and ethnic disparities are also clear. Among adults with medical debt, half of Hispanic people and 56% of Black people have medical debt, vs. 37% of non-Hispanic White adults. And Hispanic and Black people are 39% more likely to have debt collection judgments against them. These patterns tend to follow the geographic patterns, since Black and Hispanic people are more likely to live in south and southeastern states.

Lower-income people are more vulnerable to medical debt, but the problem extends beyond these households. While 57% of adults earning under $40,000 a year have medical debt, middle-class families also struggle with high bills when faced with a serious illness or injury.

The States with the Highest and Lowest Rates of Medical Debt

States with the Highest Rates:

- South Dakota 17.7%

- Mississippi 15.2%

- North Carolina 13.4%

States with the Lowest Rates:

- Hawaii 2.3%

- California 3.9%

- Oregon 5.2%

Everything is Bigger in Texas, Even Medical Debt

Although not the state with the highest percentage, almost 11% of Texans carry medical debt. That’s about 2,300,000 people. Dallas-Ft. Worth leads the nation in medical debt. Of the nation’s 20 most populous counties, the highest concentration of medical debt is in Tarrant County, home to Fort Worth. In Tarrant County, 27% of residents have medical debt on their credit reports. Second is Dallas County, with 22.5% of adults carrying reported medical debt, according to credit bureau data.

Understanding Why Medical Debt Occurs

System Failures Contribute to Medical Debt

A majority of people who reported having past-due medical debt owe money to hospitals. Many hospitals that receive tax benefits for providing community services don’t adequately inform patients about financial assistance programs. Instead, some of them aggressively pursue collections, even suing patients who might have qualified for free or discounted care.

Insurance practices also contribute to medical debt. Health plans with complex benefits, hidden limits, and/or narrow networks can leave insured patients confused and exposed to unexpected costs. Practices such as automatic claim denials can also add debt for services that should have been covered. The billing process is often confusing as well, with billing errors like duplicate charges common enough that patients should carefully review every provider statement.

Insurance Coverage Gaps Put Your Finances at Risk

Over 90% of U.S. residents have health insurance of some type. Health insurance should theoretically protect people from medical debt, but many Americans are underinsured. Their health plans have high deductibles, big copays, limited networks, or other restrictions that can expose them to large out-of-pocket costs if they need care. According to a 2024 study, 1 in 3 adults are unable to afford or access affordable quality healthcare.

Short-term insurance plans present particular risks. For example, one small business owner purchased a short-term plan for about $500 a month for two people. When he needed a colonoscopy, his insurer told him he could use any facility. However, his plan had a hidden $1,000 daily cap for outpatient procedures, leaving him responsible for over $7,000 of a $10,000 bill after his insurance paid about $800. (Luckily for this patient, his bill was greatly reduced after media questions about the interpretation of his coverage.)

These limited-duration plans can appear comprehensive but contain restrictions that you only find out about when you need care. Even traditional employer-based insurance increasingly requires employees to pay thousands of dollars to meet deductibles before coverage begins. Employer plans may also prevent access to better marketplace options.

Medical Emergencies, No Time for Price-Shopping

Emergencies are particularly threatening to your finances. They don’t allow time for price-shopping or verifying who is in your provider network. In emergencies, patients have no control over which doctors treat them, which facility they’re taken to, or what the final costs will be.

The federal Emergency Medical Treatment and Labor Act (EMTALA) requires that hospitals treat emergency patients regardless of ability to pay. However, hospitals only have to “stabilize” you, not provide all your follow-up care, which costs more. And EMTALA does not mean free care for an emergency — you will usually still be charged.

Chronic Conditions = More Financial Pressures

People with ongoing health conditions face extra financial pressures. Diabetes patients, for example, require regular monitoring appointments and medications. People with diabetes have more than double the healthcare expenses each year as those without it. The level of chronic conditions like diabetes in a community predicts the amount of medical debt there.

Cancer treatment has even greater financial challenges, with new cancer drugs averaging more than $24,000 a month. Even with insurance, the expenses of cancer treatment and related costs can be overwhelming and last for years beyond active treatment. Research shows that cancer patients are more likely to declare bankruptcy than people without cancer, and those who went bankrupt are more likely to die than those who did not.

How Decoding Health Care Can Help

Helping people lessen or avoid the burden of medical debt is the main reason we created Decoding Health Care. Our tools for you include our website, blog articles, newsletter, and resources. By understanding how to navigate the healthcare and insurance systems, understanding the billing systems, and learning practical tips to save money on out-of-pocket expenses, you can protect your finances.

Follow Decoding Health Care for future articles on avoiding medical debt while navigating the healthcare system, using financial assistance programs, understanding your legal rights, the health consequences of medical debt, what to do about medical debt in collections or on your credit report, and more.

Our book, Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money, is a comprehensive consumer guide to understanding health insurance and health coverage options in the U.S. This includes individual and group insurance, Medicaid and Medicare, and other types of coverage. It includes many practical tips to help you decipher the options and save money.

Sign up for our newsletter to get monthly news and money-saving tips delivered straight to your inbox!

—————–

Article by Lauren R. Jahnke, MPAff, author of Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money.

This article provides general information about medical debt. For guidance specific to your situation, consult financial counselors, billing advocates, or legal aid organizations in your area.

Disclosure: AI tools were used to assist with researching and writing this article, but human subject matter experts always extensively revise, fact-check, edit, and approve our content.

Decoding Health Care provides independent and educational information and does not endorse any specific insurance plans or other health coverage products.

Protect Your Finances from the Healthcare System

Subscribe now to receive our monthly newsletter. You’ll get the latest healthcare, financial, and insurance-related news and tips that affect your pocketbook.