How to Maximize Your Health Savings Account (HSA) and What’s New in 2026

In an ever-changing healthcare landscape, understanding and managing your medical expenses can feel like a full-time job. But what if there was a way to not only save money on your immediate healthcare needs but also build a tax-advantaged nest egg for the future? That’s the power of a Health Savings Account (HSA).

If you’re among the millions of Americans with a high-deductible health plan, an HSA is an important financial tool you can’t afford to overlook. Whether you have an individual plan or are covered by your employer, understanding how HSAs work is the key to stretching your healthcare budget and helping to secure your financial future.

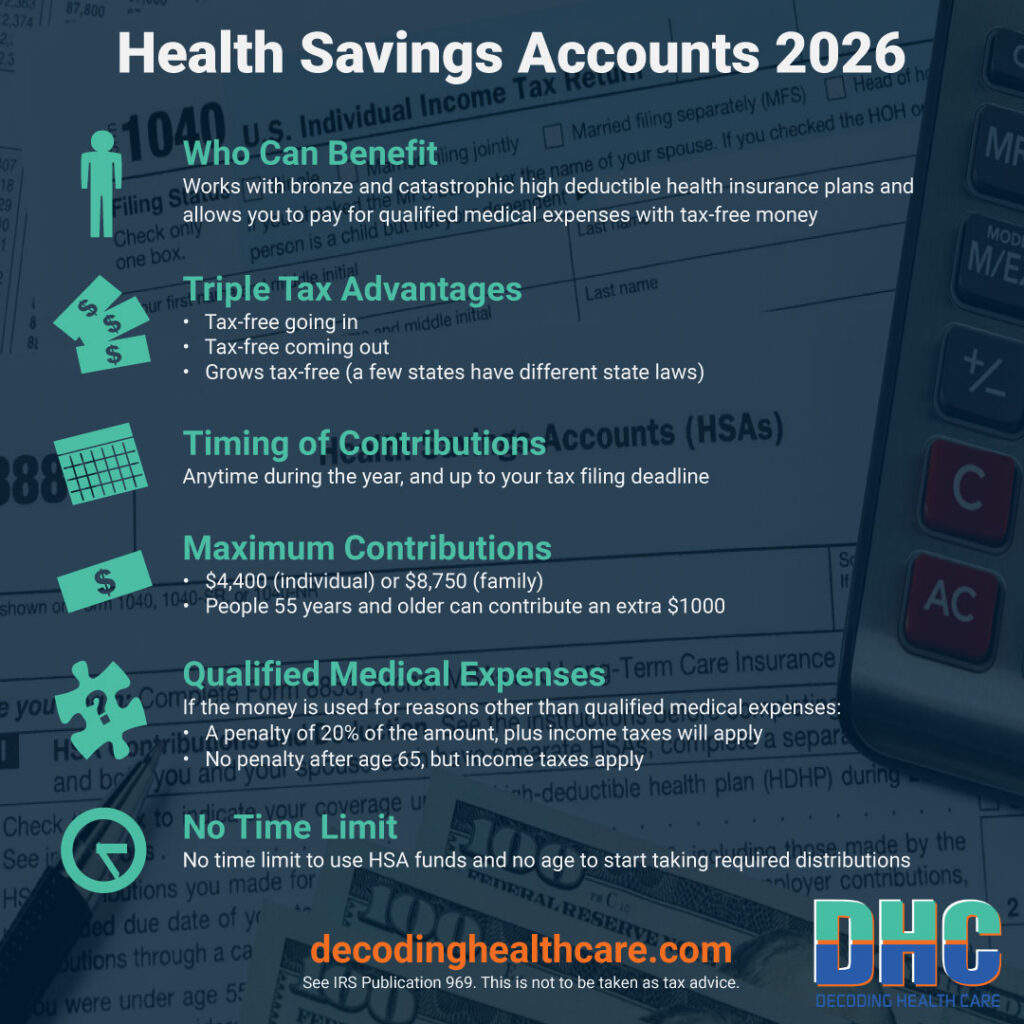

The Triple Tax Advantage: The Core of Your Health Savings Account’s Power

HSAs are called “triple-tax-advantaged” since they help you save on income taxes in three different ways. Here is what each of those three tax benefits means for your wallet in simple terms.

- Tax-Deductible Contributions: Every dollar you put into your HSA is money you don’t have to pay federal income tax on, so that’s a big deal. For example, if you contribute the full individual limit of $4,400 in 2026 and you’re in a 22% marginal tax bracket, you could save over $900 on your tax bill for the year! Think of it as an immediate discount on your healthcare spending. This is also why many employers make it easy to contribute directly from your paycheck on a pre-tax basis.

- Tax-Free Growth: Unlike a regular savings account where interest is taxed, any money you earn in an HSA grows completely tax-free. Many HSA providers allow you to invest a portion of your funds once you hit a certain balance. This means any interest, dividends, or capital gains you earn are not subject to a single dime of tax as long as they stay in the account. This is a game-changer for long-term savings.

- Tax-Free Withdrawals: The money you take out to pay for qualified medical expenses is also completely tax-free. This creates an unparalleled financial opportunity: you put in money that lowers your taxable income, it grows tax-free, and then you can withdraw it for healthcare costs (in the same year or future years) without paying any tax. This is the ultimate trifecta for your healthcare finances.

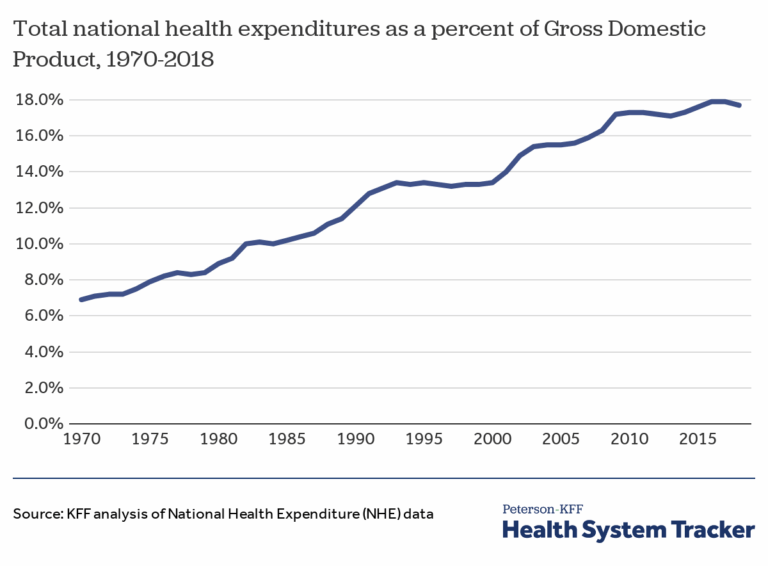

New Rules for 2025 and 2026: What’s Changed and What You Need to Know

To make sure you are maximizing your HSA and staying compliant, you need to be aware of some new rules and laws that have recently taken effect.

2026 Contribution Limits and Plan Requirements

The IRS adjusts HSA limits each year. Here are the most important numbers for 2026:

- Individual Coverage: You can contribute up to $4,400.

- Family Coverage: You can contribute up to $8,750.

- Catch-up Contributions: If you are age 55 or older, you can contribute an extra $1,000 per year from age 55 to 65. (As long as you stay insured by a qualifying HDHP.) This amount does not usually change, unlike the other limits.

- HDHP Plan Requirements for 2026: To be eligible for an HSA, your health plan must be considered high-deductible. This means it must have a deductible of at least $1,700 for individuals or $3,400 for families. The annual out-of-pocket maximum (which includes deductibles, co-payments, and co-insurance) cannot exceed $8,500 for individuals or $17,000 for families.

- Helpful New Changes to Plan Requirements: Retroactive to January 1, 2025, HDHPs can cover telehealth and other remote services before the deductible is met and still qualify to be used with an HSA. This 2025 law, which made permanent some temporary Covid-era laws, opened up more HDHP options for 2026 and allows many more people to be eligible to use HSAs. Also, starting in 2026, all bronze and catastrophic plans available in as well as outside of the ACA marketplaces are eligible to be used with HSAs.

Major New Law: Direct Primary Care is Now HSA-Compatible!

This is one of the most significant changes for HSA users. Previously, having a direct primary care (DPC) arrangement could make you ineligible for an HSA. However, a law passed in 2025 now allows individuals to participate in DPC arrangements and still be eligible to contribute to an HSA, if their DPC fees are below a specified amount. (The amount is $150/month for an individual or $300/month for a family, which will like increase every year.) Furthermore, you can now use your HSA funds to pay for your DPC membership fees, up to a certain limit. This provision, which took effect January 1, 2026, opens up a new world of affordable, relationship-based healthcare for millions of people.

Maximizing Your HSA: The “Super-Saver” Strategy

Here are some ways to leverage your HSA for the long haul, if you are interested in this strategy. Think of your HSA not just as a checking account for medical bills, but as a retirement account specifically for healthcare.

Use Your HSA as a Retirement Tool

Many people don’t realize that after age 65, your HSA acts like a traditional retirement account. You can withdraw funds for any reason without the 20% penalty that those under 65 have if they use their funds for non-medical purposes — though non-medical withdrawals will still be subject to regular income tax. This makes it a very flexible part of your retirement plan, alongside your 401(k) and/or IRA. This is a perfect reason for putting money into an HSA when you are younger. It can grow tax-free for many years.

Most people have higher medical expenses when they are older, so you can avoid income taxes on the money altogether if you continue to use HSA withdrawals for qualifying health expenses only. This includes premiums for Medicare insurance (but not Medigap supplemental insurance).

The “Pay-from-Pocket” Strategy

This is a popular tactic for “super-savers.” Instead of using your HSA to pay for a medical bill today, pay for it out-of-pocket and save the receipt. Let your HSA funds continue to grow tax-free. You can then reimburse yourself for those expenses years, or even decades, later. This allows your money to work for you for as long as possible.

The only requirement is that you must save your receipts to prove the expense was a qualified medical expense in case you are ever audited. You may want to save paper copies as well as digitally scan them and keep them in an electronic folder with the date in each file name. It is also helpful to quickly log them into a spreadsheet with the date and amount so you can keep a running total each year.

Timing Your Contributions and What Happens If You Over-Contribute

You can put money in your HSA every month, once a year in a lump sum, or a few times a year. Just make sure you keep good records because it’s important not to accidentally contribute more than the annual limit for individual or family health plans. If you do, you could face a 6% excise tax on the excess amount. The good news is you can usually avoid this penalty by simply withdrawing the excess contribution and its earnings from your account before the tax filing deadline.

Key Takeaways

Here’s a quick summary of what you need to remember about your HSA:

- You’re in control: The account is yours, and it moves with you if you change jobs.

- It’s a powerful financial tool: It offers a triple tax advantage that no other type of account can match.

- The rules have changed for the better: New laws in 2025 and 2026 make HSAs even more valuable by expanding the benefits and types of qualifying health plans.

- Don’t wait: Even if you can’t contribute the maximum amount, start putting in what you can. The earlier you start, the more your money will grow over time.

For details on all the rules for HSAs, you can refer to IRS Publication 969. Before you make any major financial decisions, always consult with a qualified financial advisor. Armed with this information, you can take a significant step toward mastering your healthcare finances and building a more secure future for yourself and your family.

If you want to learn more, get Decoding Health Care’s free downloadable cheat sheet (guide): “Health Savings Accounts, Tax Considerations Regarding Individual Health Insurance.”

Article by Lauren R. Jahnke, MPAff, Author of Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. (Chapter 6 contains more on HSAs.)

Disclosure: AI tools were used to assist with researching and writing this article, but human subject matter experts always extensively revise, edit, fact-check, and approve our content.

Decoding Health Care provides independent and educational information and does not endorse any specific insurance plans or other health coverage products.