How Can I Get Help with Medical Debt?

As we have mentioned in previous articles, medical debt is a huge problem in the U.S. There are various resources available to help people who struggle with high medical bills and medical debt. However, you may not be aware of all of them. These include financial assistance (such as hospital charity care), retroactive insurance coverage in certain situations, patient advocates who can assist or negotiate on your behalf, and crowdfunding.

Financial Assistance for Medical Bills

In our last article, 8 Steps to Keep Medical Debt Off Your Credit Report, we covered important steps you should take to protect your credit score when faced with medical debt. Step 5 involved applying for financial assistance to help reduce or eliminate medical debt. Here’s more about financial assistance.

Hospital Charity Care

Most hospitals offer Financial Assistance Programs (FAPs). These are usually posted on their websites (such as this example in Texas), or you can ask for a copy and an application. FAPs often include charity care, which is means-tested free or discounted services for emergency and medically necessary care. Non-profit hospitals are required by federal law to offer charity care to those who meet the hospital’s eligibility guidelines. However, research shows many people who would be eligible never apply.

Hospitals have broad flexibility in establishing eligibility rules. These policies may only cover certain physicians or may require patients to reside in certain zip codes or have limited resources. Charity care is calculated on a sliding scale. Many working people qualify for discounts even if they don’t receive completely free care.

To qualify for hospital charity care, people generally fall into one of two categories:

- Financially indigent: people earning less than two to three times the federal poverty level

- Medically indigent: people whose medical bills, after all third-party payments, exceed a certain percentage of their yearly household income or assets

To apply for charity care, be prepared to provide documents such as pay stubs to prove income. Some hospitals will give charity care retroactively, writing off existing debts for qualifying patients. It’s important to note that there is often a time limit for applying for charity care. It’s usually 240 days or 8 months after you receive the first bill. Fortunately, you can go to DollarFor to quickly screen and apply for hospital charity care programs for free!

Payment Plans for Medical Bills

If you don’t qualify for charity care, there are other forms of patient financing. Many medical providers offer payment plans for medical bills, allowing you to pay off the balance interest-free. To protect your credit, it’s best to deal with your provider’s office, rather than with debt collectors who may later purchase the debt.

Don’t Overpay

Before agreeing to a payment plan or the amount owed, make sure you are not being overcharged. These items were covered in Steps 6 and 7 in 8 Steps to Keep Medical Debt Off Your Credit:

- Make sure any applicable insurance coverage has been applied.

- Scrutinize large bills for errors and contact the medical provider to resolve them.

- Conduct price research on the billing codes to find fair rates and use this information to negotiate.

Negotiate Medical Bills

You could also try to negotiate a lower bill based on cash prices, a lump sum settlement offer, a large down payment discount, or the Medicare rate.

If you want to know more, download our free guide 6 Ways to Negotiate Lower Healthcare Bills. You’ll learn some steps you can take, both proactively and reactively, to minimize healthcare bills and negotiate lower medical bills, whether you’re insured, underinsured, or uninsured.

Medical Credit Cards

Other medical providers use patient financing through third parties that charge interest. One common patient financing tool is medical credit cards. Although called “medical” or “care” cards, or even sometimes listed on a provider’s financial assistance webpage, these are consumer credit cards that carry high interest rates. They should be used with caution and reserved only for elective care that can be paid in full before the promotional period ends and interest kicks in.

Retroactive Insurance Coverage

Retroactive insurance coverage (sometimes called backdated coverage) may cover some past bills in certain circumstances. Retroactive coverage means an insurance policy is applied to a period before the date you actually enrolled. It may be available when:

- Bills from that earlier period can be submitted to the insurer.

- Providers reprocess claims and reduce what you owe.

- Health plans need to correct enrollment errors.

If you qualify in your state, backdated insurance coverage may be available through Medicaid and certain marketplace Special Enrollment Periods. Medicaid retroactive coverage for certain eligible populations, such as pregnant women, may cover past medical bills up to three months.

Medical Billing and Insurance Advocates

You may also consider using a medical bill advocate and/or an insurance advocate. These are types of patient advocates who specialize in challenging high medical bills, assisting with insurance appeals and financial aid applications, and negotiating lower medical bills. Patient advocates may work for hospitals, nonprofits, insurance companies, or large employers. These patient advocates provide services at no cost to the patient.

Other advocates work independently, allowing them to prioritize the patient’s interests. Independent advocates may charge you a flat fee for their services or a percentage of the savings. Greater National Advocates can help you find an independent patient advocate by location or specialty.

In addition, anyone can use a free, nonprofit tool called Advocara. The Advocara AI medical billing tool is trained specifically on medical billing and insurance negotiation. It helps with bill analysis, appeal letters, negotiation scripts, and legal insights.

Crowdfunding and Community Support

Community Help for Medical Bills

Sometimes help for medical debt can be found from local community funds, or from church or civic organizations. 211.org is a good place to start the search. Additionally, individuals have found GoFundMe to be a useful platform for raising money for healthcare expenses through online communities.

Avoiding Medical Debt in the First Place

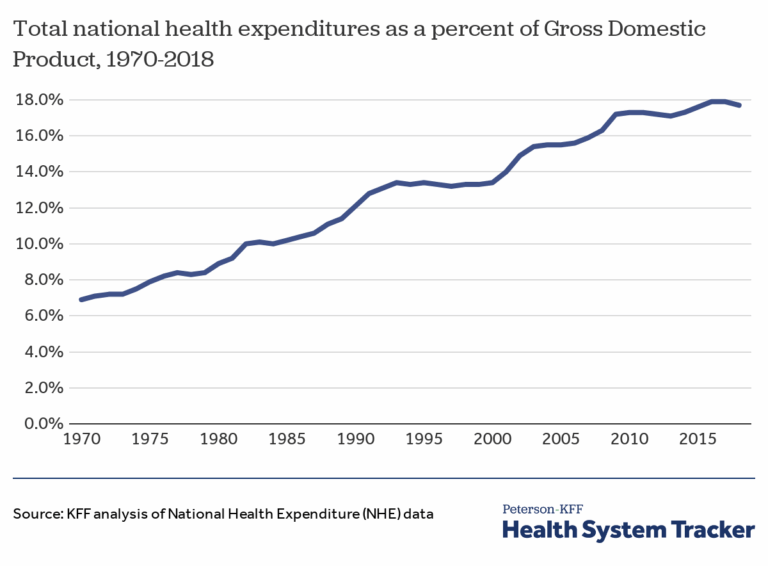

If you read our article Medical Debt: A Threat to Your Finances, you learned that medical debt occurs despite over 90% of U.S. residents having health insurance of some type. This underinsured majority is exposed to large out-of-pocket costs, making 1 in 3 adults unable to access affordable quality healthcare, and leaving millions with medical debt.

Look out for our future articles on managing out-of-pocket costs, where we explore how to avoid medical debt in the first place!

Our book, Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money, is a comprehensive consumer guide to understanding health insurance and health coverage options in the U.S. It includes many practical tips to help you decipher the options and save money.

—————–

Article by Julie Gunstanson, Certified Medical Billing Advocate, and Lauren R. Jahnke, MPAff, author of Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money.

Disclosures: AI tools were used to assist with researching this article; however, human subject matter experts always extensively revise, fact-check, edit, and approve our content. This article provides general information about medical debt. For guidance specific to your situation, consult financial counselors, billing advocates, or legal aid organizations in your area. Decoding Health Care provides independent and educational information and does not endorse any specific insurance plans or other health coverage products.

Protect Your Finances from the Healthcare System

Subscribe now to receive our monthly newsletter. You’ll get the latest healthcare, financial, and insurance-related news and tips that affect your pocketbook.