How to Reduce Your Healthcare and Insurance Costs

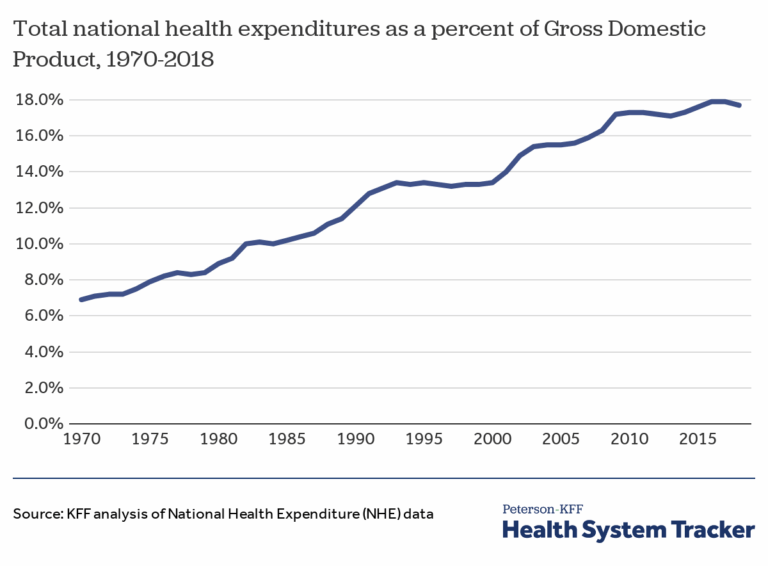

Millions of people are experiencing sticker shock as they watch the price tag for insurance and healthcare costs climb. So, you may be wondering how to reduce your healthcare and insurance costs.

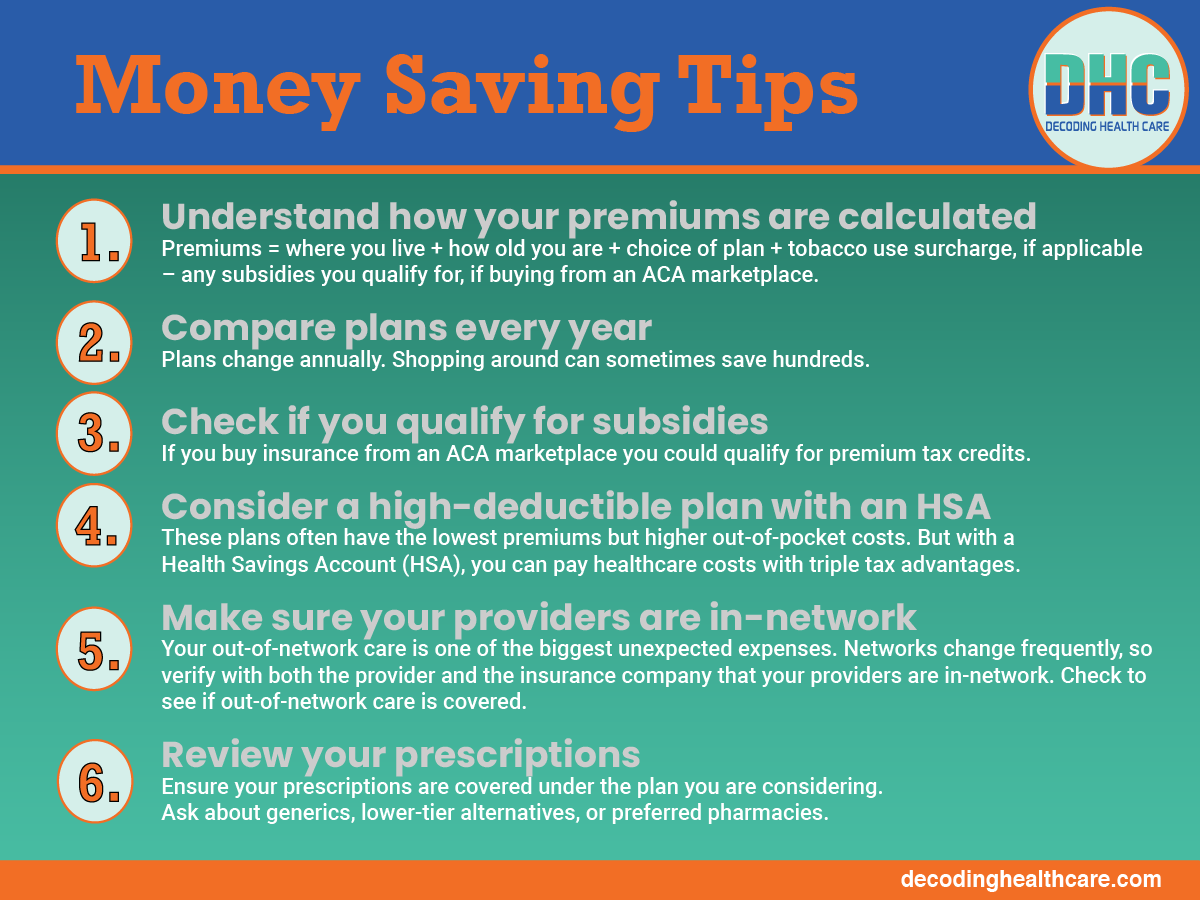

Tips for Reducing Healthcare Costs

1. Understand how your premiums are calculated.

Your health insurance premium = where you live + how old you are + the plan you choose + tobacco use surcharge, if any – any subsidies you may qualify for, if buying from an ACA marketplace such as healthcare.gov

2. Compare plans every year.

Plans change annually. Shopping around can save hundreds. You can use healthcare.gov or your state’s ACA marketplace, a broker, or a health insurance agent to help you compare plans.

Protect yourself: Buying insurance from a random seller who sends you unsolicited messages via text or email could expose you to scams or identity thieves.

3. Check if you qualify for subsidies, if applicable.

Many people who purchase ACA coverage through healthcare.gov or their state exchange qualify for marketplace tax credits and may not even realize it. Although the enhanced subsidies we’ve had since 2021 have expired, the original ACA subsidies remain in place.

4. Consider a high-deductible plan with an HSA.

These plans often have the lowest premiums, but also expose you to higher out-of-pocket costs when you need healthcare services. However, with a Health Savings Account (HSA), you can pay for healthcare costs with triple tax advantages.

This may not be a good option if you have a chronic condition or generally use a lot of healthcare services.

5. Make sure your doctors and care team are in-network.

When you use insurance, your out-of-network care is one of the biggest unexpected expenses. Networks change frequently, so verify with both the provider and the insurance company that your providers are in network. Check to see if out-of-network care is covered if you want to see providers outside of your insurance plan’s network.

6. Review your prescriptions.

Check your plan’s formulary, or list of covered prescriptions. Ensure that your prescriptions are covered under the plan you are considering. Ask about generics, lower-tier alternatives, or preferred pharmacies.

Don’t forget: Arm yourself with health insurance literacy.

Let Decoding Health Care be your guide to health insurance literacy.