Everything You Need to Know About the Affordable Care Act in One Short Blog Post

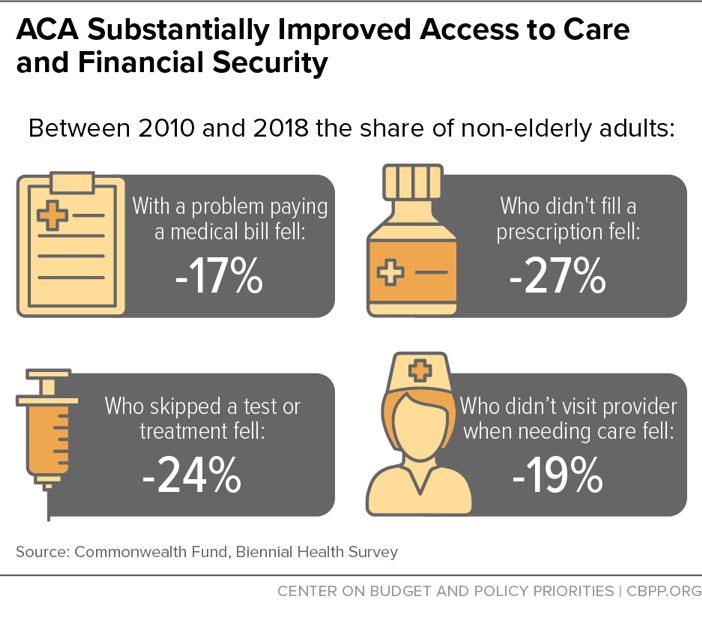

The Affordable Care Act (ACA) of 2010, or Obamacare as the bill is sometimes known, significantly reformed multiple areas of health insurance policy in the United States. While the ACA continues to be amended (and detractors try to weaken it), its overarching goal is to increase access to health insurance. In Chapter 2 of Decoding Health Insurance and the Alternatives, Lauren Jahnke writes, “[The ACA] attempts to fix many issues experienced in different parts of the healthcare system, including in the individual insurance market, Medicaid, and Medicare. It also offers new consumer protections and other programs.”

Major Ways the ACA Reformed Health Care

Here are a few major ways the Affordable Care Act of 2010 transformed the health care system in the U.S.

Ten essential health benefits

All individual health plans in the ACA marketplaces are required to provide 10 essential health benefits. You can get details on all 10 at Healthcare.gov, but they include outpatient care, emergency health care, surgery and overnight hospitalizations, maternity and newborn care, mental health, prescription drugs, preventive and wellness services, and laboratory services.

This increase in the types of health services required to be available in individual insurance plans had the following positive affects.

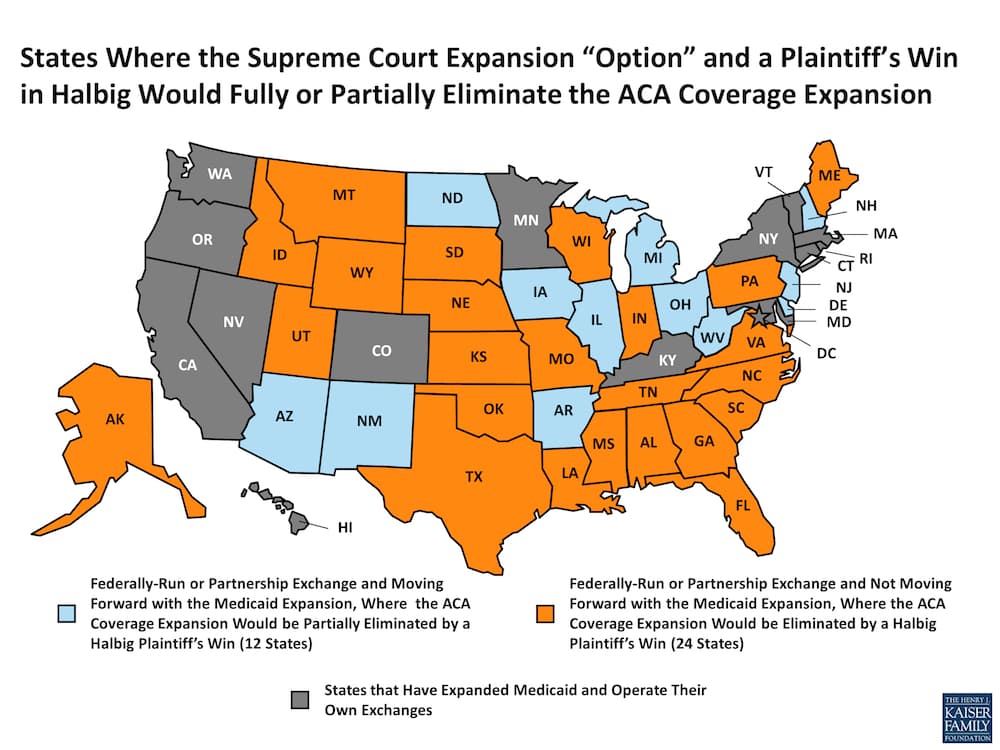

Establish individual insurance marketplaces

Marketplaces were established so that people can compare individual health care plans and prices in one place. States were given the option to create their own marketplaces or use the federal system (Healthcare.gov). The Kaiser Family Foundation compiled a report detailing marketplace types by state. In 2025, 20 states operate their own individual health insurance marketplaces, 3 states operate their own marketplace but rely on the platform developed by the federal government, and 28 states do not operate a marketplace and use the federal marketplace.

Tax subsidies

Subsidies, also known as tax credits, were created to help people pay for individual health insurance if they qualify based on income. Subsidies were set up to reduce the cost of monthly premiums by the government paying a set amount directly to your insurance company each month. These amounts are then reconciled and adjusted as needed on the following year’s income taxes.

Preexisting conditions

The law required insurers to cover preexisting conditions. Prior to the ACA, customers could be denied coverage or get kicked off their health insurance plan for conditions like pregnancy, diabetes, or heart disease. In other words, anyone could be disqualified from a health plan or coverage for almost any reason. According to the Centers for Medicare & Medicaid Services, “50 to 129 million (19 to 50 percent of) non-elderly Americans have some type of preexisting health condition.”

Starting in 2014, individual insurance plans can no longer deny coverage or charge higher premiums if a customer has a preexisting condition, including a life-threatening illness or chronic condition.

Preventive care

Insurers were required to provide in-network preventive care, such as immunizations, mammograms, and cholesterol blood tests, at no additional cost to patients.

Individual mandate

The individual mandate was a penalty charged to anyone (except those who qualified for an exemption) who did not have health insurance. After lawsuits, it was eventually repealed — or, technically, the penalty was reduced to $0. By 2020, five states and Washington, D.C., had reinstated an individual mandate, according to eHealth.

After the individual mandate was eliminated on a federal level, Sarah Kliff wrote in the New York Times, “Participation in Obamacare marketplaces has decreased slightly, to 11.4 million this year from 12.2 million in 2017. But it hasn’t plummeted or shown any signs of a ‘death spiral,’ in which only sick patients purchase coverage and premiums become unaffordable.” According to the Kaiser Family Foundation, the individual mandate was a very minor reason why people opted for or against enrolling in health insurance.

Coverage for kids

The ACA lets children stay on their parents’ health plans until age 26. There were also provisions for kids in the foster care system. Prior to the ACA, kids aged out of their parents’ plans by age 19 or 22, depending on their student status. The first year the ACA went into effect, roughly 7.8 million young people were able to stay on their parents’ health insurance plans if they needed to, according to NBCNews.com.

No annual or lifetime caps

Before the ACA, insurance companies could cut patients off if they had high medical expenses and hit an arbitrary dollar limit on their plan. Insurers could ding customers on two fronts: by implementing a lifetime dollar limit and an annual dollar limit. In this way, ACA individual insurance helps patients avoid high medical debt when they have significant medical conditions requiring expensive treatment.

Expand Medicaid eligibility

The ACA gave states the option to expand Medicaid eligibility for adults under the age of 65. Non-elderly adults whose income was at or below 138% of the poverty line could qualify for Medicaid. Since states run Medicaid programs, after lawsuits were filed a judge ruled that states could determine whether or not to expand their Medicaid programs to those with higher incomes. The ten (as of 2025) states that have opted out of the expansion have left millions of financially insecure Americans without health care coverage, according to the Kaiser Family Foundation.

Employer provisions

Small businesses can obtain health insurance through the Small Business Health Options Program (SHOP) marketplace. Also, certain businesses with fewer than 25 full-time employees that offer health insurance may qualify for a tax credit. In a 2018 Commonwealth Fund study titled “The Affordable Care Act’s Impact on Small Business,” the authors wrote, “[T]he uninsured rate for small-business employees fell by almost 10 percentage points post-ACA.” The researchers also stated that the law helped “stabilize health costs for many small businesses that provide coverage, with the rate of small-business premium increases falling by half following implementation of the law.”

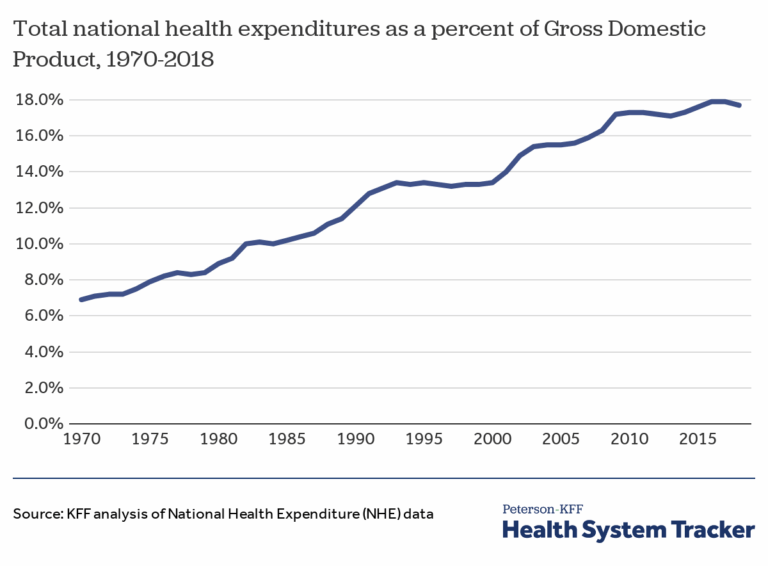

Why is Health Care Coverage Controversial?

So why has the ACA been so controversial for so long? This question doesn’t really have a simple, pithy answer. But conservatives say they don’t like the added tax costs and as far as the health care industry is concerned, implementing new policies can be time-consuming and expensive. The private health insurance industry didn’t like some of the ACA provisions and hired lobbyists to fight it. It’s indisputable that the law has helped a lot of people. According to Jahnke, “The only issue is that adding more benefits and protections inevitably causes the price of health insurance to go up as insurance companies pay for more health care, so it’s a double-edged sword that is very difficult to adequately resolve.”

Read Decoding Health Insurance

To better understand the U.S. health care system, check out Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. You’ll find informative, nonpartisan information and tips for buying health insurance and saving money on health care, whether or not you have insurance.