The Rising Cost of Health Care in the US

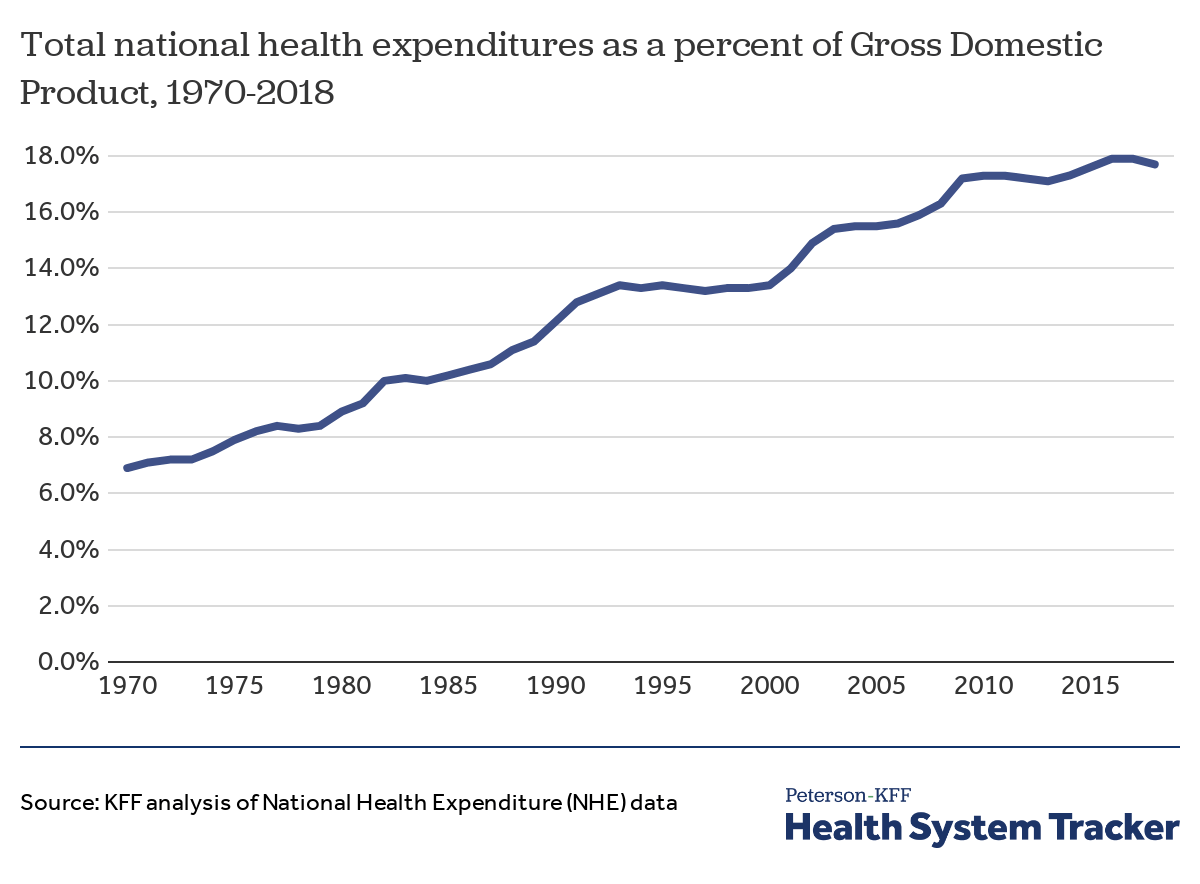

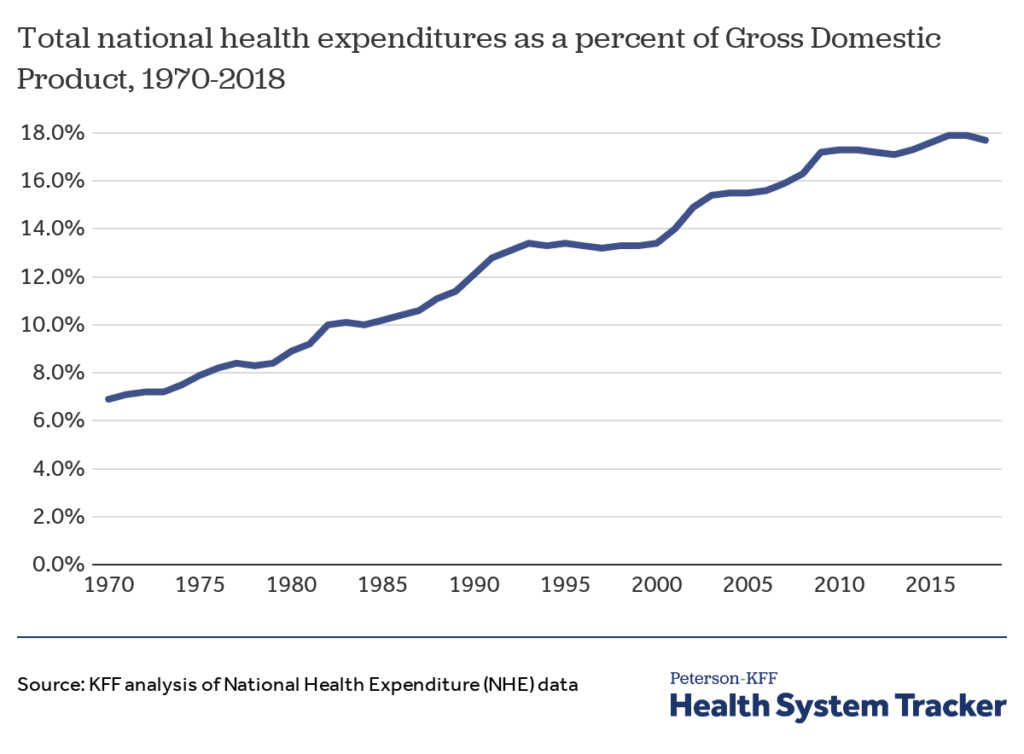

In the first chapter of our book Decoding Health Insurance and the Alternatives; Options, Issues, and Tricks for Saving Money, author Lauren Jahnke homes in on the rising cost of health care in the U.S. It’s one thing to read about it. It’s very different to actually see evidence of how costs went from 6.9% of U.S. gross domestic product (GDP) in 1970 to nearly 18% of GDP in 2017.

This. Is. Not. Sustainable.

Workers are on Their Own

The rising cost of health care and health insurance coverage is hitting non-full-time employees — as in contractors, freelancers, and gig-economy workers — more than most others. This list includes the people who drive for Uber and Lyft, artists, entertainers, people who work in the media, and more.

In 2018, NPR’s “All Things Considered” podcast ran a segment on “The Rise of the Contract Workforce.” Yuki Noguchi reported that “Within a decade, contractors and freelancers could make up half of the American workforce.” When it comes to benefits, though, these workers are not on equal footing with full-time employees. A 2017 poll by NPR/Marist shows that 69% of full-time workers had access to employer health insurance. By comparison, only 46% of contractors/freelancers had access. This is a big problem that’s not going to go away on its own. The country needs to have this conversation right now.

Listen to the “All Things Considered” podcast segment here:

“If self-employed, contract, alternative, and other workers do not receive employer benefits and don’t have insurance through a spouse’s employment, they’re on their own to find a source of health insurance for themselves (and possibly their families) or to access needed health services in other ways without insurance.”

Decoding Health Insurance and the Alternatives, by Lauren R. Jahnke

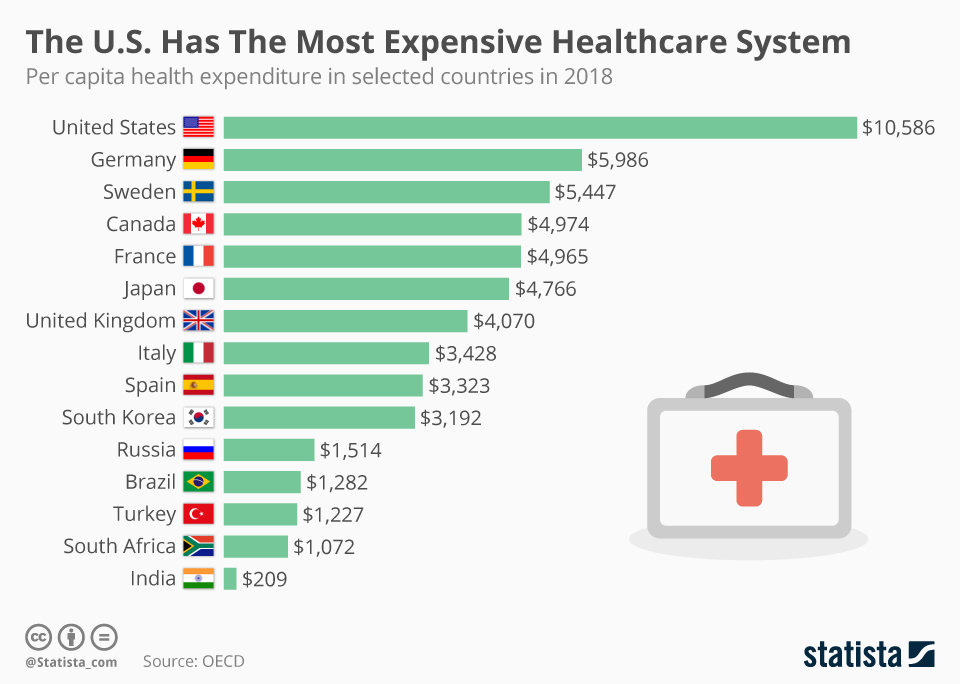

Most Expensive Health Care

“The U.S. has the most expensive health care in the world, but not necessarily the best,” according to author Jahnke. The international Organisation for Economic Cooperation and Development (OECD) ranked health expenditure in select wealthy countries. Check out where the U.S. stands.

We’re the Worst

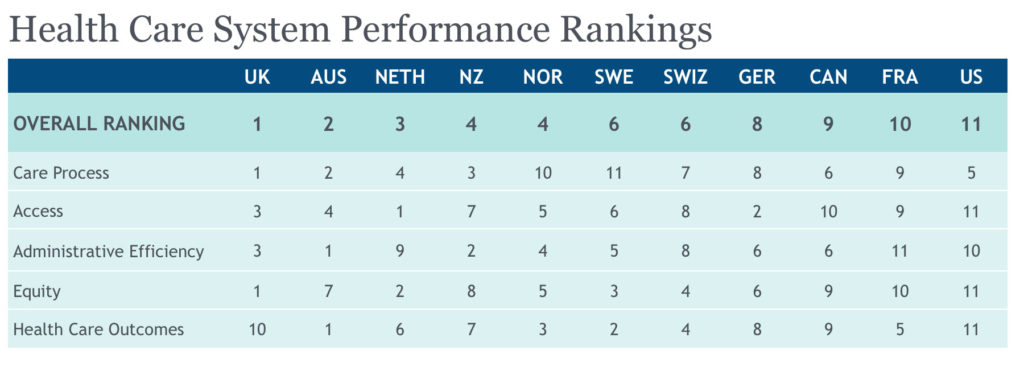

Compared to 10 other nations, the U.S. also ranks lowest in a variety of metrics, from access to care to health care system efficiency, equity, and outcomes. In just one metric, “care process,” did the U.S. rank in the upper half of the nations included in a Commonwealth Fund 11-country study from 2017.

In the report, Mary Mahon, a former vice present at The Commonwealth Fund, states, “Your level of income defines the health care you receive far more in the United States than in other wealthy nations.” Most notable is that even despite recent improvements to health insurance coverage and policy, the U.S. health care system still stinks. “[A]nd it works especially poorly for those with middle or lower incomes,” says Commonwealth Fund president, David Blumenthal, MD. So those who need health care the most can’t get it or they pay more for care and/or coverage by income percentage compared to higher-income earners.

Read Decoding Health Insurance

To better understand the U.S. health care system and the options available for all types of workers and earners, check out Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. You’ll find informative, nonpartisan information and tips for buying health insurance and saving money on health care, whether or not you have coverage.